is oregon 529 college savings plan tax deductible

Professional and Experienced Academic Writers. To learn more about your states taxes deductions and credits visit your states Department of Revenue or Department of Taxation website.

529 Insiders Bottom Right Banner As Of August 28 2017 529 College Savings Plan Saving For College College Savings Plans

The Plan offers five investment options to best suit your needs.

. This change eliminates some cost and hassle when it comes to tax-related estate planning. You can choose your academic level. This was offset by about a 4000 loss on my startup business on my 1040 along with some other incidentals leaving me with about 20000 for line 37 of my 1040 MAGI.

All our clients are privileged to have all their academic papers written from scratch. For example some states offer a deduction or credit for contributions you make to a 529 College Savings Plan while others offer great deductions for age andor retirement income. The contributions made to the 529 plan however.

Pernsteiner also served as Chancellor of the Oregon University System from July 2004 through May 2013. New Yorks 529 College Savings Plan is a special account that helps you pay for your childs higher education. High school collegeuniversity or professional and we will assign a writer who has a respective degree.

The state income tax rates range from 2 to 575 and the general sales tax rate is 53 which is 43 state tax and 1 local tax. A Bank Savings option. Nebraska residents that contribute to an Enable Savings Plan account are elligible for a Nebraska State tax deduction.

On the Job is a 2013 Philippine crime-thriller film conceived and directed by Erik Matti pictured who co-wrote it with Michiko YamamotoStarring Gerald Anderson Joel Torre Joey Marquez and Piolo Pascual it tells the story of two prisoners Anderson and Torre who are temporarily freed to carry out political executions and two law enforcers Marquez and Pascual investigating a. This savings vehicle provides some exceptional tax benefits such as tax-free growth on your earnings and tax-free withdrawals for eligible medical expenses. Many are native speakers and able to perform any task for which you.

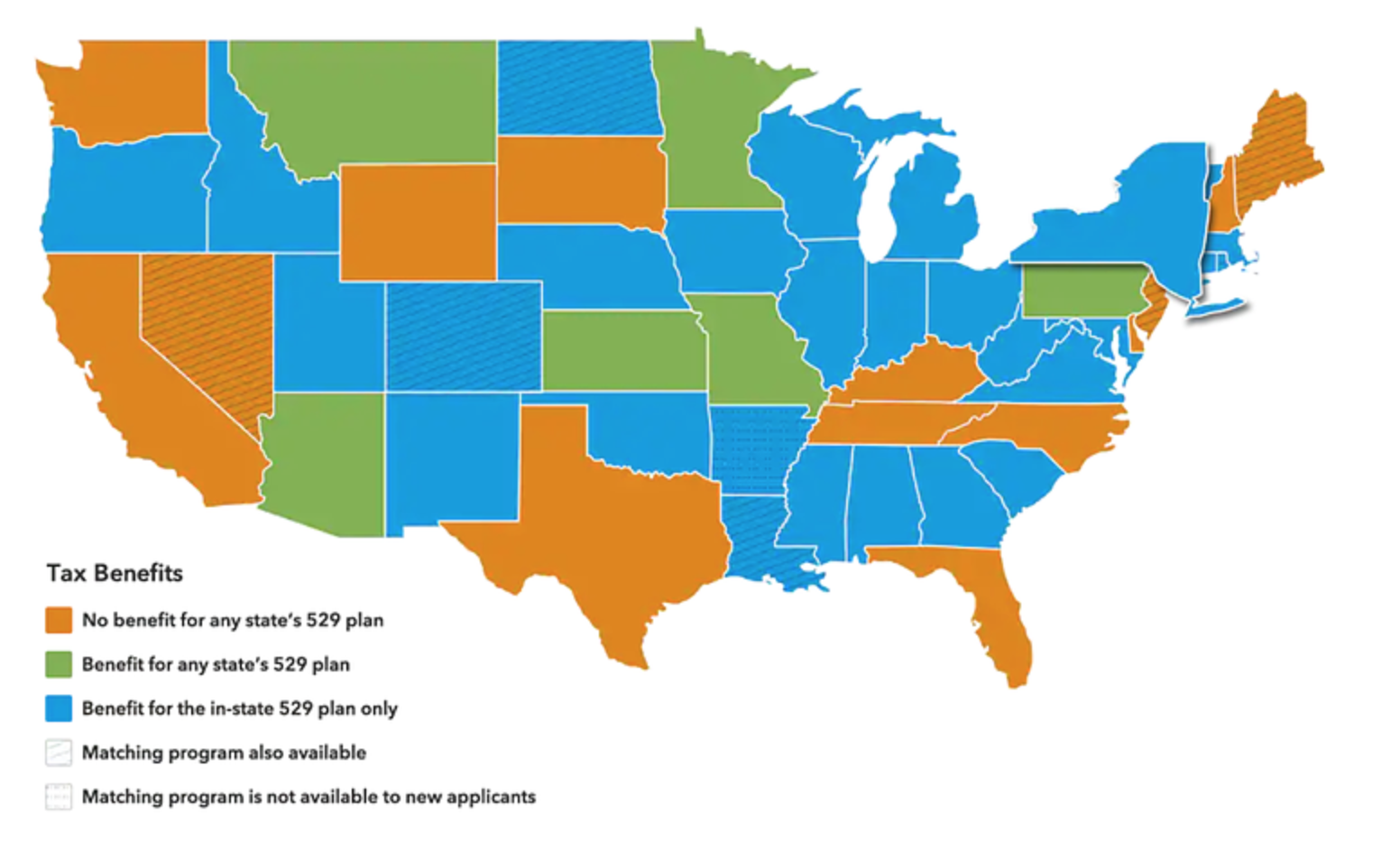

There are any number of reasons to love 529 plans as a college savings option such as the lack of federal income tax and the flexibility to add or invest money how you see fit but some states take the advantages of their 529 plans a step further by offering state income tax benefits. With that said every family who is subject to the 15000 per year limit on giftsincluding 529 college savings plan contributionswill get some relief since the 15K limit is part of the federal estate tax code. Berthoud if youre already enrolled in an eligible high-deductible health plan HDHP.

We have a team of professional writers with experience in academic and business writing. Unified Tax Credit. A 529 plan allows you to save for college or higher education while receiving some type of tax benefit.

All our academic papers are written from scratch. These papers are also written according to your lecturers instructions and thus minimizing any chances of plagiarism. A tax credit that is afforded to every man woman and child in America by the IRS.

3 mutual fund options Growth Moderate and Conservative. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or. Evergreen or workplace retirement savings vehicle like a 401kplan.

This comprehensive 529 plan comparison tool lets you compare over 40 features including investment options state income tax benefits and more. Unlike the Vanguard 529 Plan it offers a generous tax benefit for Ohio taxpayers. And a Checking Investment option that comes with a free debit card.

I converted a portion of an IRA to a ROTH last year got a 1099-r with a TAXABLE amount of 23000 with a distribution code of 2. If the state income tax benefit is offered per beneficiary parents with multiple children should consider opening a 529 plan for each child to maximize the potential state tax savings. A In generalThere is hereby imposed on the income of every individual a tax equal to the sum of 1 12 PERCENT BRACKET12 percent of so much of the taxable income as does not exceed the 25-percent bracket threshold amount 2 25 PERCENT BRACKET25 percent of so much of the taxable income as exceeds the 25-percent bracket threshold amount but does not.

Earnings from 529 plans are not subject to federal tax and generally not subject to state tax when used for qualified education expenses such as tuition fees books as well as room and board. CollegeAdvantage is Ohios 529 college savings plan. To easily compare 529 plan fees and performance try the 529 Consumer Comparison Tool.

This includes paying for college or other post-secondary school tuition and qualified education expenses including registered apprenticeship program expenses. This credit allows each person to gift a. If you have three kids en route to college thats up to 12000 in state tax deductions each year.

Nebraska offers married taxpayers a state tax deduction for 529 plan contributions to a 529 plan of up to 10000 per year. For families facing the possibility of a huge tuition bill when their child grows up these deductions. A state income tax deduction worth up to 4000 per beneficiary per year.

Contributions are not deductible for federal income tax purposes. Alongside a College Savings 529 Plan and Student Debt Repayment program for eligible. Some regions may assess additional s.

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Oregon Able Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Tax Benefits Oregon College Savings Plan

Able Infographic By Oregon How To Plan Life Experiences Better Life

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

Tax Benefits Oregon College Savings Plan

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans State Tax 529 College Savings Plan

Oregon 529 Plan And College Savings Options Or College Savings Plan

Michigan Education Savings Program Mesp Saving For College College Savings Plans 529 Plan

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Straightforward Guide To 529 College Saving Plans Root Financial Partners

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Tax Benefits Oregon College Savings Plan

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

Kiplinger S Picks Saving For College College Savings Plans 529 College Savings Plan

529 Plans Which States Reward College Savers Adviser Investments